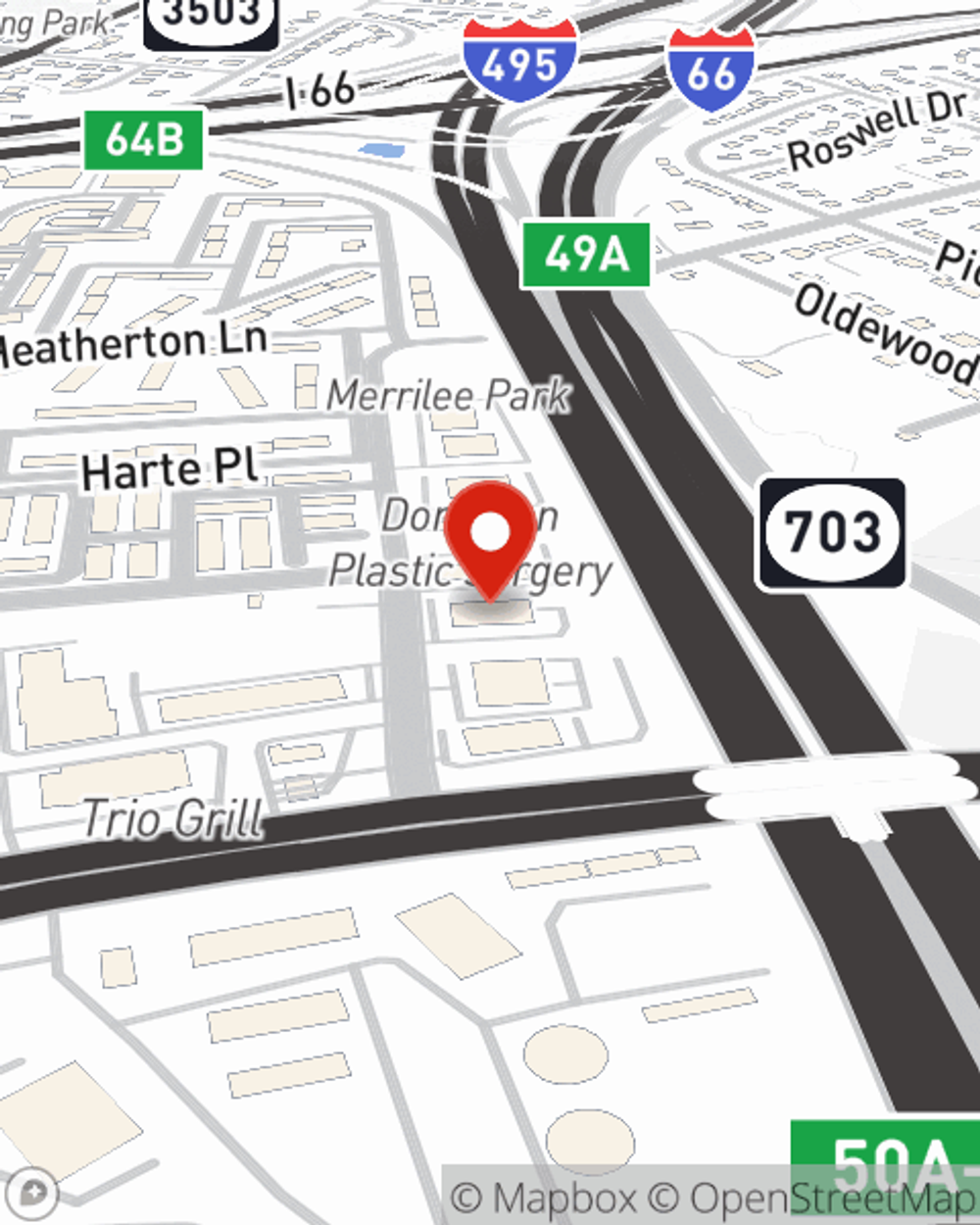

Business Insurance in and around Falls Church

One of Falls Church’s top choices for small business insurance.

No funny business here

- Arlington

- Arlington County

- Fairfax

- Fairfax County

- Alexandria

- City of Alexandria

- Falls Church

- Mclean

- VIENNA

- CHANTILLY

- TYSONS

- MERRIFIELD

- ANNANDALE

- SPRINGFIELD

- BURKE

- RESTON

- HERNDON

- OAKTON

- STERLING

- ASHBURN

- LEESBURG

- GREAT FALLS

- MANASSAS

- WOODBRIDGE

Insure The Business You've Built.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Kenya Knight. Kenya Knight gets where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

One of Falls Church’s top choices for small business insurance.

No funny business here

Get Down To Business With State Farm

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a surveyor or a real estate agent or you own a vet hospital or a candy store. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Kenya Knight. Kenya Knight is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

Reach out to the exceptional team at agent Kenya Knight's office to discover the options that may be right for you and your small business.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Kenya Knight

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.